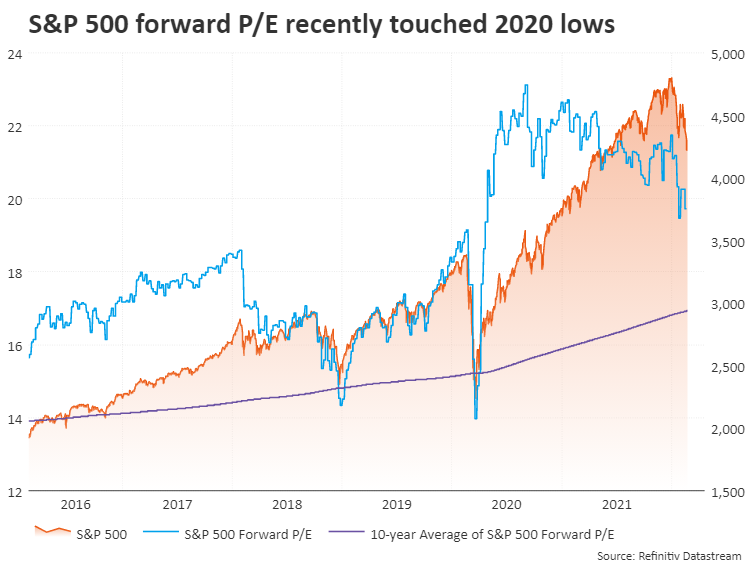

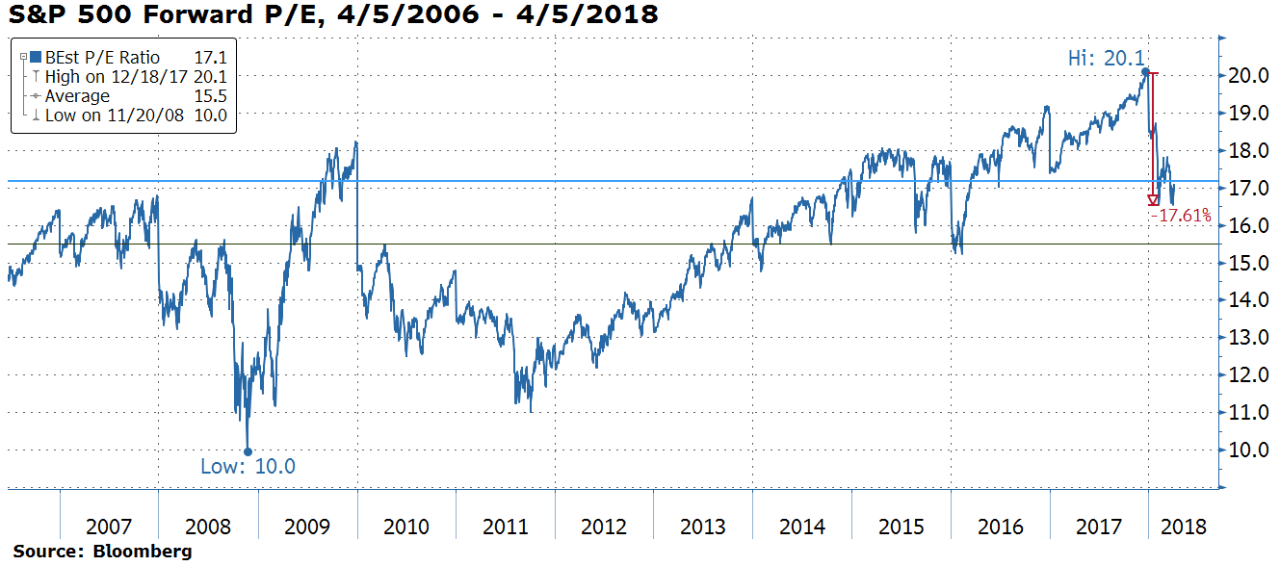

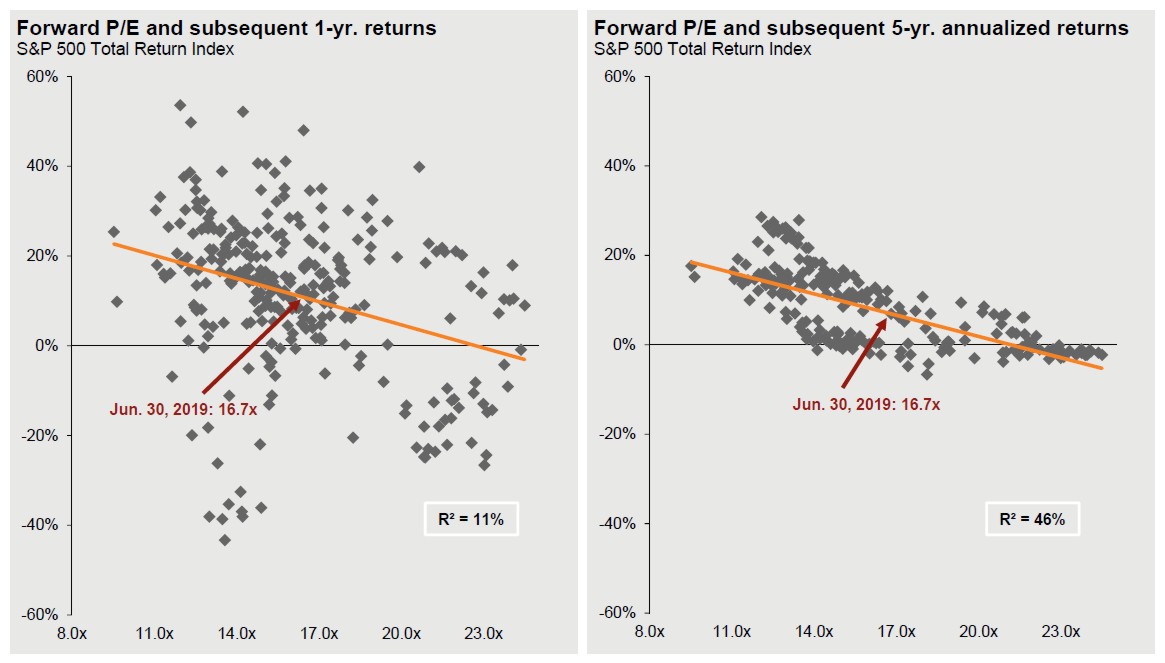

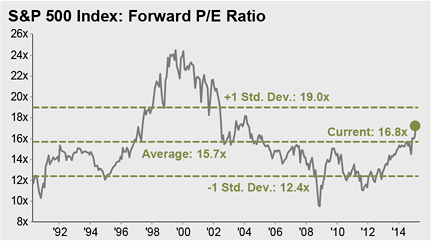

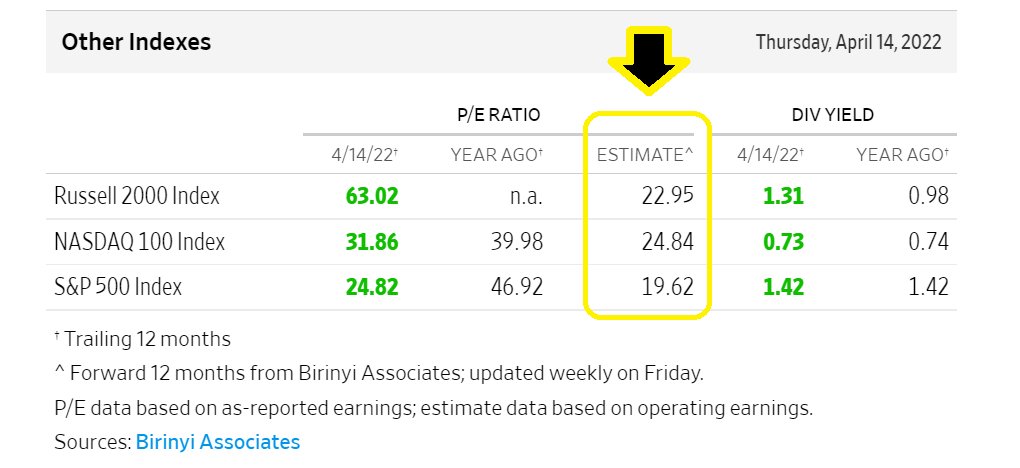

The S&P 500 trades at 24.5 times forward earnings, a level last seen during the dot-com bubble two decades ago. Should investors be concerned? - Quora

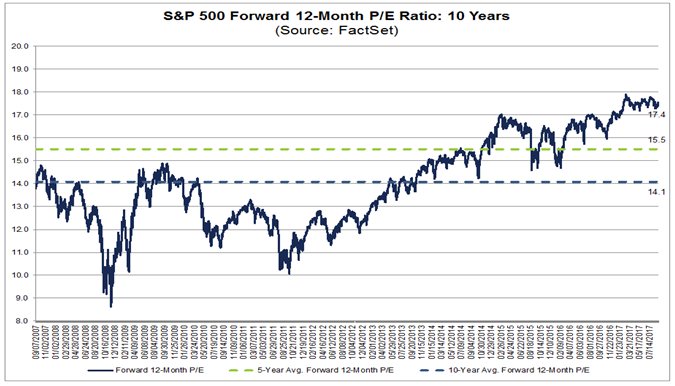

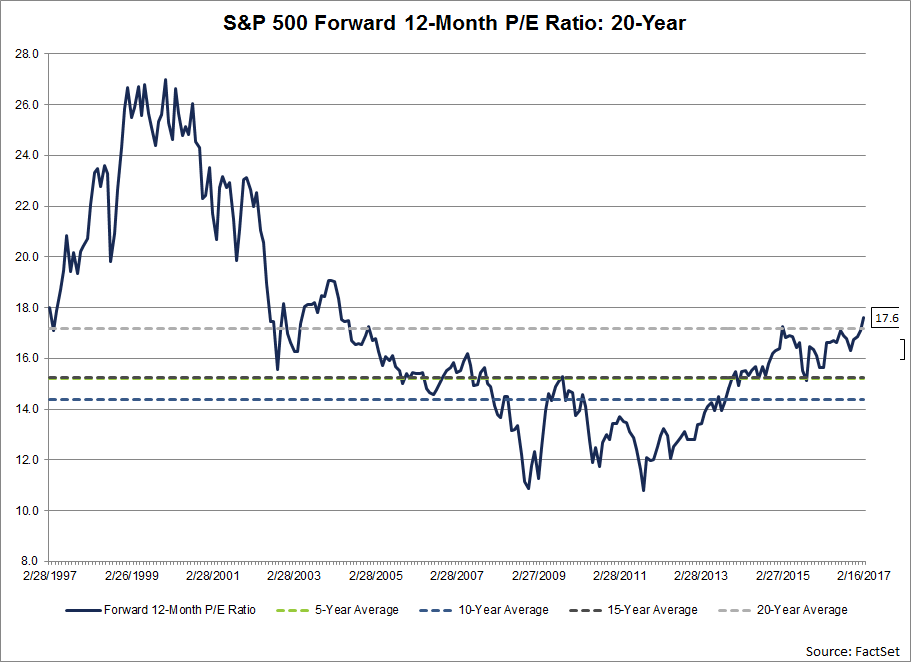

FactSet no Twitter: "The forward 12-month P/E ratio for $SPX is 17.4, above the 10-year average of 14.1. https://t.co/Nfhid2JR2u https://t.co/BU6p3XeqrE" / Twitter

Simon Johnson on Twitter: "...for the period and the ending equity. It can be done either way but calculations will defer base on how this is done." / Twitter

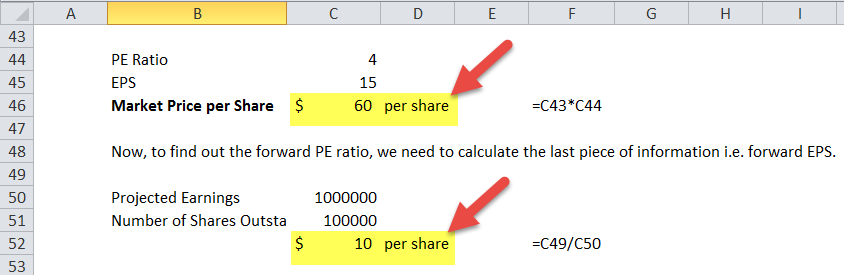

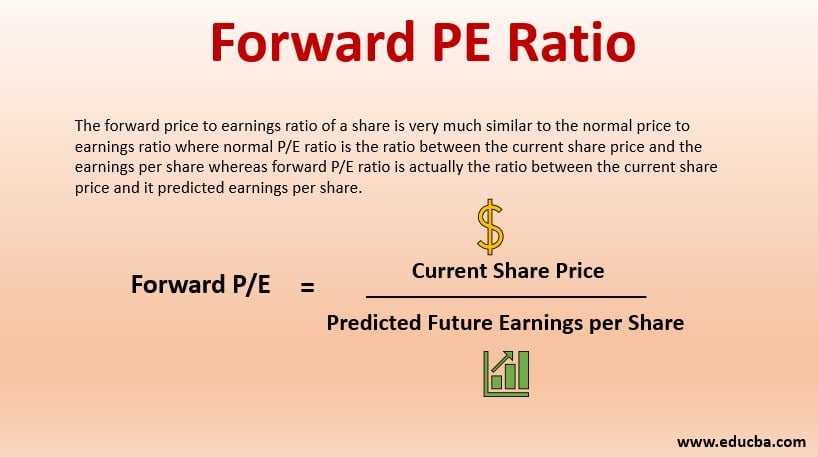

:max_bytes(150000):strip_icc()/ForwardPEExcel3-0ba2a5c058754af28f56dab765f301b4.jpg)

:max_bytes(150000):strip_icc()/TermDefinitions_ForwardPrice-to-Earnings-10870a56b1c74ec1beba56fa293dfca4.jpg)

Insight/2020/02.2020/02.21.2020_EI/S%26P%20500%20Forward%2012%20month%20PE%20ratio.png)